Soaring Prices Hurt Jewelry Demand – The Himalayan Times – Nepal’s No.1 English Daily Newspaper

KATHMANDU, 6 MARCH

Escalating tensions between Russia and Ukraine saw the price of precious metals in the domestic market soar to a 17-month high today, causing jewelers to twiddle their thumbs as customers stayed away.

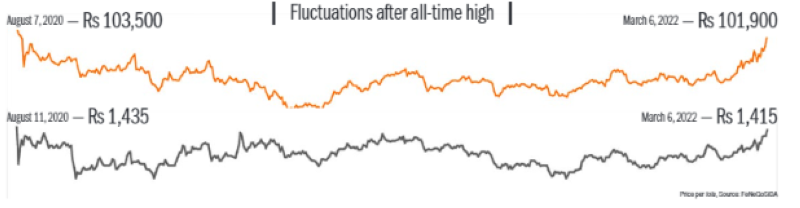

The price of gold rose a whopping 2,000 rupees per tola and is now trading at 101,900 rupees per tola. The yellow metal was trading at Rs 99,900 per tola on Friday. The last time gold traded above 100,000 rupees per tola was on August 19, 2020 when it was valued at 100,400 rupees per tola. It had hit a record high of 103,500 rupees per tola on August 7, 2020.

Silver prices were also up 35 rupees per tola from the previous trading day on Friday and are trading at 1,415 rupees per tola today. The last time the gray metal traded above 1,400 rupees per tola was on August 11, 2020 when it traded at 1,435 rupees per tola, which was a record high for silver.

At the time, the price of precious metals had skyrocketed amid fears surrounding rising cases of the coronavirus around the world.

Precious metals are seen as safe havens in times of crisis, and the ongoing war between Russia and Ukraine has increased its appeal, said Mani Ratna Shakya, former president of the Federation of Nepal Gold and Silver Dealers’ Association (FeNeGoSiDA).

The price of precious metals on the domestic market is determined by their rates on the international markets.

The current turn of events could not have come at a worse time for jewelry retailers hoping for a post-pandemic business recovery.

Tekenra Rahapal, who has run a small jewelry shop in Bagdole, Lalitpur, for 18 years, said demand for gold has plummeted in the past week.

“Business is zero because of the rising price of gold.”

Another jeweler, Saroj Shakya, who entered the jewelry business just a few months ago, also shared that retail demand for gold is next to non-existent right now. According to Saroj, he had managed to sell just one ring in the whole week.

Analysts say the price of precious metals will set new records if the Russia-Ukraine crisis continues.

“And if that happens, it will destroy jewelry stores and could lead to job losses in the industry,” Mani Ratna warned.

Gold prices are already at $1,940 an ounce, according to the World Gold Council (WGC), and analysts have predicted that the yellow metal’s price could reach as high as $2,000 an ounce in the international market if tensions between Russia and Ukraine ease not common.

A version of this article will appear in the March 7, 2022 issue of The Himalayan Times.

Comments are closed.